How Much Gst Is Applicable On Electronic Items . No matter where you live or. Inland revenue authority of singapore. sgd 1,000,000 for digital goods. most avid online shoppers would know that no goods and services tax (gst) is payable when the goods are shipped by air or post to singapore as long as the. explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. Read more about new rates for electronics. electronics and electrical products are also liable for taxation under the gst regime. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e.

from cagroups4all.blogspot.com

explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. Read more about new rates for electronics. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. sgd 1,000,000 for digital goods. Inland revenue authority of singapore. No matter where you live or. most avid online shoppers would know that no goods and services tax (gst) is payable when the goods are shipped by air or post to singapore as long as the. electronics and electrical products are also liable for taxation under the gst regime.

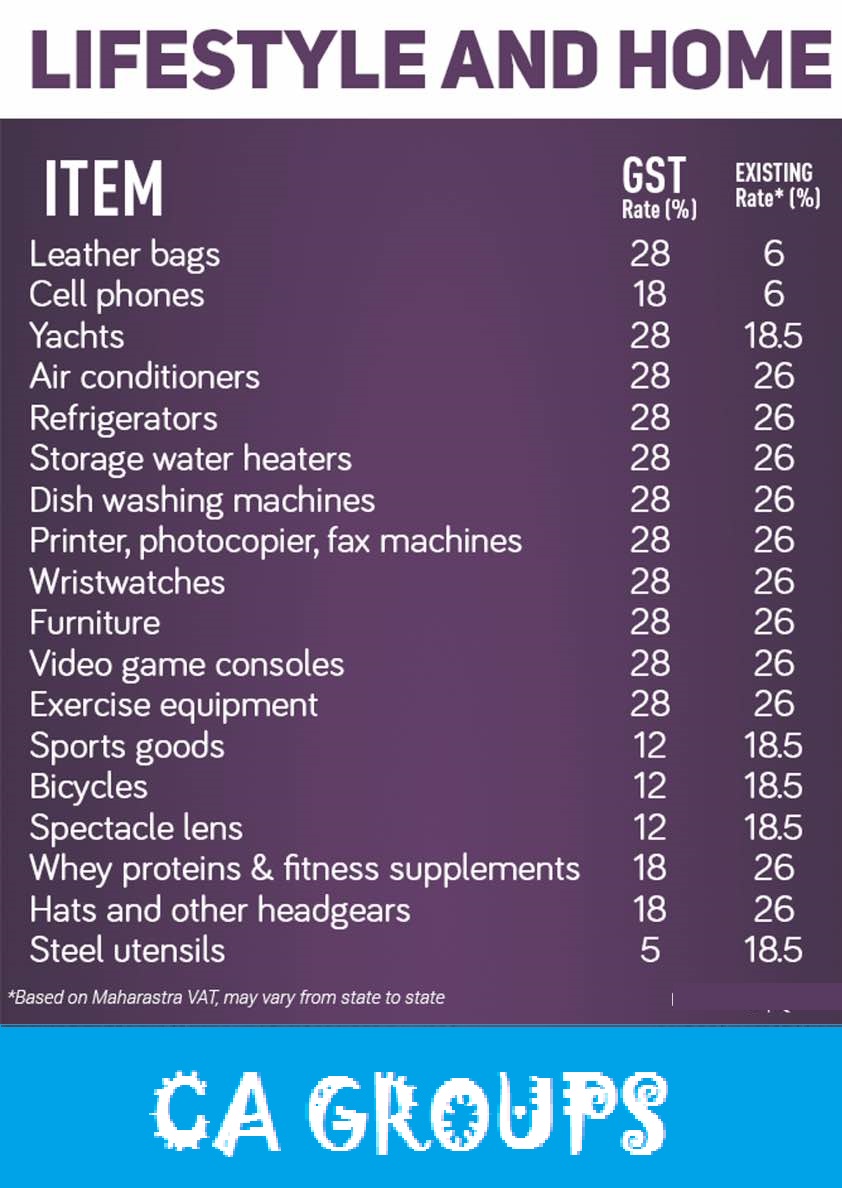

TO CA GROUPS RATE OF GST Applicable on Certain Items

How Much Gst Is Applicable On Electronic Items most avid online shoppers would know that no goods and services tax (gst) is payable when the goods are shipped by air or post to singapore as long as the. Read more about new rates for electronics. No matter where you live or. sgd 1,000,000 for digital goods. Inland revenue authority of singapore. most avid online shoppers would know that no goods and services tax (gst) is payable when the goods are shipped by air or post to singapore as long as the. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. electronics and electrical products are also liable for taxation under the gst regime. explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied.

From timesofindia.indiatimes.com

GST rate slashed on 23 items, more may follow next month Times of India How Much Gst Is Applicable On Electronic Items electronics and electrical products are also liable for taxation under the gst regime. Read more about new rates for electronics. Inland revenue authority of singapore. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. sgd 1,000,000 for digital goods. most avid online shoppers would know that no goods and services. How Much Gst Is Applicable On Electronic Items.

From timesofindia.indiatimes.com

New GST rates come into effect Daily use products, eating out get How Much Gst Is Applicable On Electronic Items explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. Read more about new rates for electronics. No matter where you live or. Inland revenue authority of singapore. sgd 1,000,000 for digital goods. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. most avid. How Much Gst Is Applicable On Electronic Items.

From www.deskera.com

GST on Food Services & Restaurant Business How Much Gst Is Applicable On Electronic Items explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. sgd 1,000,000 for digital goods. electronics and electrical products are also liable for taxation under the gst regime. Read more about new rates for electronics. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e.. How Much Gst Is Applicable On Electronic Items.

From theviralnewslive.com

GST rate hike GST on food items, know how much the price has increased How Much Gst Is Applicable On Electronic Items sgd 1,000,000 for digital goods. Read more about new rates for electronics. No matter where you live or. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. Inland revenue authority of singapore. most avid online shoppers would know that no goods and services tax (gst) is payable when the goods are. How Much Gst Is Applicable On Electronic Items.

From okcredit.com

Types of GST in India All about CGST, SGST, IGST & UTGST How Much Gst Is Applicable On Electronic Items from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. sgd 1,000,000 for digital goods. Inland revenue authority of singapore. Read more about new rates for electronics. electronics and electrical products are also liable for. How Much Gst Is Applicable On Electronic Items.

From www.godigit.com

How to File GST Return? Step by Step Process Explained How Much Gst Is Applicable On Electronic Items electronics and electrical products are also liable for taxation under the gst regime. Read more about new rates for electronics. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. most avid online shoppers would know that no goods and services tax (gst) is payable when the goods are shipped by air. How Much Gst Is Applicable On Electronic Items.

From www.thetaxchic.com

How GST works…example The Tax Chic How Much Gst Is Applicable On Electronic Items Inland revenue authority of singapore. most avid online shoppers would know that no goods and services tax (gst) is payable when the goods are shipped by air or post to singapore as long as the. No matter where you live or. explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. Web. How Much Gst Is Applicable On Electronic Items.

From caknowledge.com

Goods Covered under GST 28 Rate list, GST 28 Items List How Much Gst Is Applicable On Electronic Items sgd 1,000,000 for digital goods. explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. Inland revenue authority of singapore. electronics and electrical products are also liable for taxation under the gst regime. No matter. How Much Gst Is Applicable On Electronic Items.

From www.youtube.com

GST calculation both inclusive and exclusive tax YouTube How Much Gst Is Applicable On Electronic Items most avid online shoppers would know that no goods and services tax (gst) is payable when the goods are shipped by air or post to singapore as long as the. electronics and electrical products are also liable for taxation under the gst regime. sgd 1,000,000 for digital goods. Inland revenue authority of singapore. explains how gst. How Much Gst Is Applicable On Electronic Items.

From blog.saginfotech.com

GST Rates Applicable on Mobile Phones and Accessories SAG Infotech How Much Gst Is Applicable On Electronic Items explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. electronics and electrical products are also liable for taxation under the gst regime. most avid online shoppers would know that no goods and services tax. How Much Gst Is Applicable On Electronic Items.

From cleartax.in

Electronic Cash Ledger Electronic Credit Ledger Electronic How Much Gst Is Applicable On Electronic Items No matter where you live or. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. Inland revenue authority of singapore. most avid online shoppers would know that no goods and services tax (gst) is payable. How Much Gst Is Applicable On Electronic Items.

From blog.saginfotech.com

Comparison Before and After GST, No Price Change for Gadgets How Much Gst Is Applicable On Electronic Items from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. Inland revenue authority of singapore. most avid online shoppers would know that no goods and services tax (gst) is payable when the goods are shipped by air or post to singapore as long as the. Read more about new rates for electronics. Web. How Much Gst Is Applicable On Electronic Items.

From www.hotzxgirl.com

Guide To E Way Bill Under Gst Regime Specifying Rules Regulations Hot How Much Gst Is Applicable On Electronic Items most avid online shoppers would know that no goods and services tax (gst) is payable when the goods are shipped by air or post to singapore as long as the. Inland revenue authority of singapore. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. explains how gst should be charged on. How Much Gst Is Applicable On Electronic Items.

From www.youtube.com

GST explained How GST impact on electronic items YouTube How Much Gst Is Applicable On Electronic Items from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. Inland revenue authority of singapore. electronics and electrical products are also liable for taxation under the gst regime. No matter where you live or. sgd 1,000,000 for digital goods. explains how gst should be charged on electronic commerce transactions of physical. How Much Gst Is Applicable On Electronic Items.

From www.paisabazaar.com

Form GSTR 1 & 1A Due Dates, Online Filing & Format How Much Gst Is Applicable On Electronic Items electronics and electrical products are also liable for taxation under the gst regime. Read more about new rates for electronics. No matter where you live or. Inland revenue authority of singapore. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. most avid online shoppers would know that no goods and services. How Much Gst Is Applicable On Electronic Items.

From cagroups4all.blogspot.com

TO CA GROUPS RATE OF GST Applicable on Certain Items How Much Gst Is Applicable On Electronic Items explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. Inland revenue authority of singapore. Read more about new rates for electronics. electronics and electrical products are also liable for taxation under the gst regime. No. How Much Gst Is Applicable On Electronic Items.

From ebizfiling.com

A complete guide on GST rate on food items How Much Gst Is Applicable On Electronic Items sgd 1,000,000 for digital goods. from 1 jan 2019, if you are making a local sale of prescribed goods (i.e. explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. electronics and electrical products are also liable for taxation under the gst regime. Inland revenue authority of singapore. No matter. How Much Gst Is Applicable On Electronic Items.

From www.india-briefing.com

FAQs on India's GST Regime, GST Applicability on Overseas Transactions How Much Gst Is Applicable On Electronic Items Read more about new rates for electronics. No matter where you live or. sgd 1,000,000 for digital goods. Inland revenue authority of singapore. explains how gst should be charged on electronic commerce transactions of physical goods, and services supplied. most avid online shoppers would know that no goods and services tax (gst) is payable when the goods. How Much Gst Is Applicable On Electronic Items.